cost of living payment 2024 federal income tax – The cost-of-living adjustment for 2025’s Social Security recipients could be as low as 1.4%, down from 3.2% this year — making it the lowest level since 2020, according to an analysis by the Senior . For both 2023 and 2024, the seven federal income tax rates are 10%, 12% That means how much you pay in taxes could be higher or lower this year than in 2023. For example, let’s say you .

cost of living payment 2024 federal income tax

Source : www.military.com

Cost of Living: Definition, How to Calculate, Index, and Example

Source : www.investopedia.com

Retired Military Pay, VA Disability and Social Security Pay

Source : www.military.com

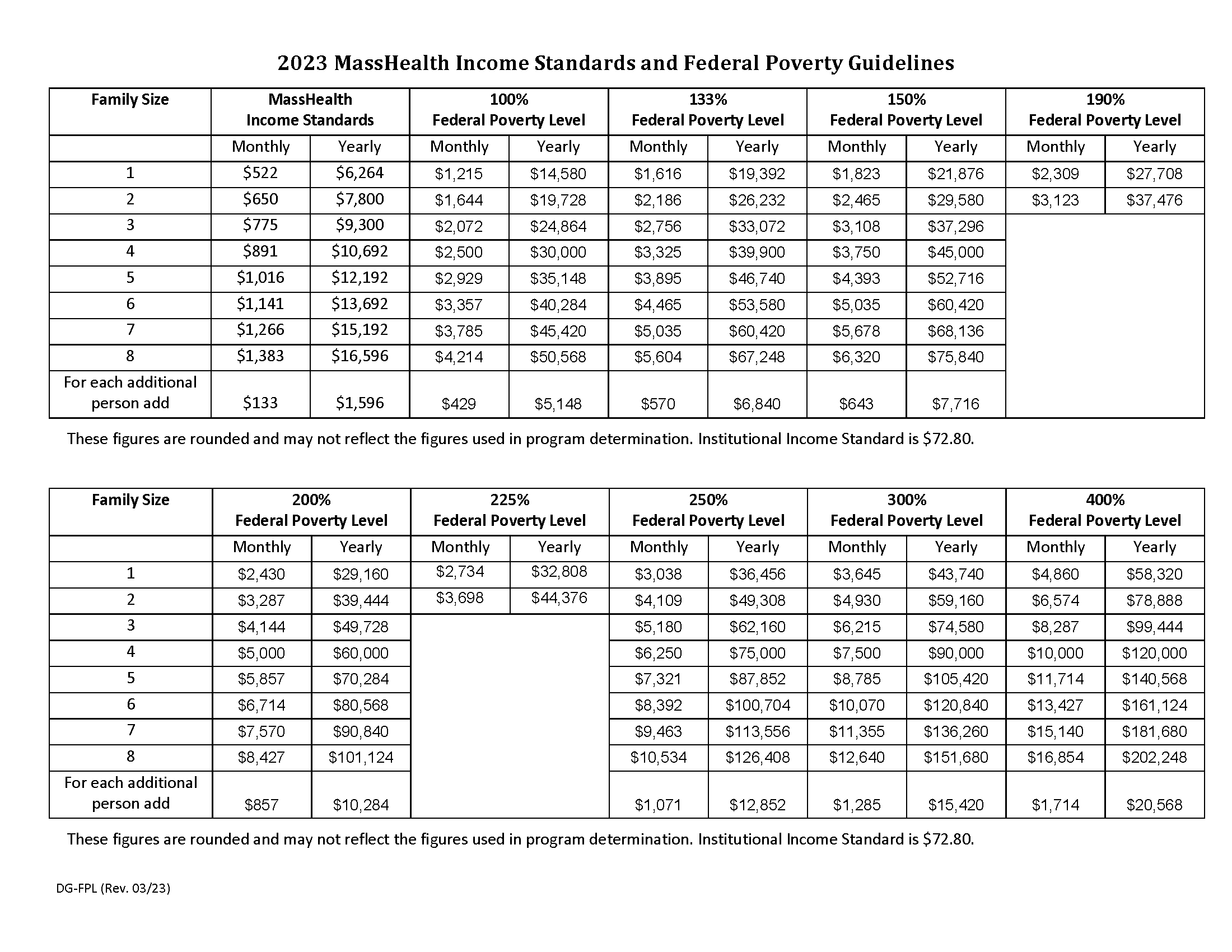

Program financial guidelines for certain MassHealth applicants and

Source : www.mass.gov

When is the next cost of living payment 2024? The Big Issue

Source : www.bigissue.com

CC Tax & Advisory

Source : www.facebook.com

Pay tables, COLA info, annuity projections | National Association

Source : www.nalc.org

Budget 2024: Here is a breakdown of €14bn package including cost

Source : uk.news.yahoo.com

What Is a Cost of Living Adjustment (COLA), and How Does It Work?

Source : www.investopedia.com

Social Security COLA Increase for 2024

Source : www.usatoday.com

cost of living payment 2024 federal income tax Retired Military Pay, VA Disability and Social Security Pay : Each year, the IRS evaluates income tax brackets and adjusts them accordingly based on inflation. According to Fox Business, tax brackets have shifted higher by 5.4% in 2024 for both single and . Millions of working Australians are in line for more cost-of-living relief after Prime high interest rates and growing income tax payments. Loading Wages have risen, which has increased .

:max_bytes(150000):strip_icc()/cost-of-living.asp-final-174921c4b73c4741aeca1503f35cc2f4.png)

:max_bytes(150000):strip_icc()/Cola_final-bf18eacfc0784a65ab5bbbb9363a848a.png)